Resale vs New Build: A Guide for First-Time Property Buyers

Are you a first-time property buyer feeling overwhelmed by the decision between purchasing a resale property versus a newly constructed one? It’s a common dilemma many new buyers face. Not to worry, this guide will break down the key considerations for you to make an informed decision that aligns with your needs and preferences.

Types of Properties to Consider

When you’re in the market for your first property, whether it’s a house, condo, townhouse, or duplex, the first decision you’ll have to make is choosing between a resale property or a new build. Each type comes with its own set of advantages and considerations.

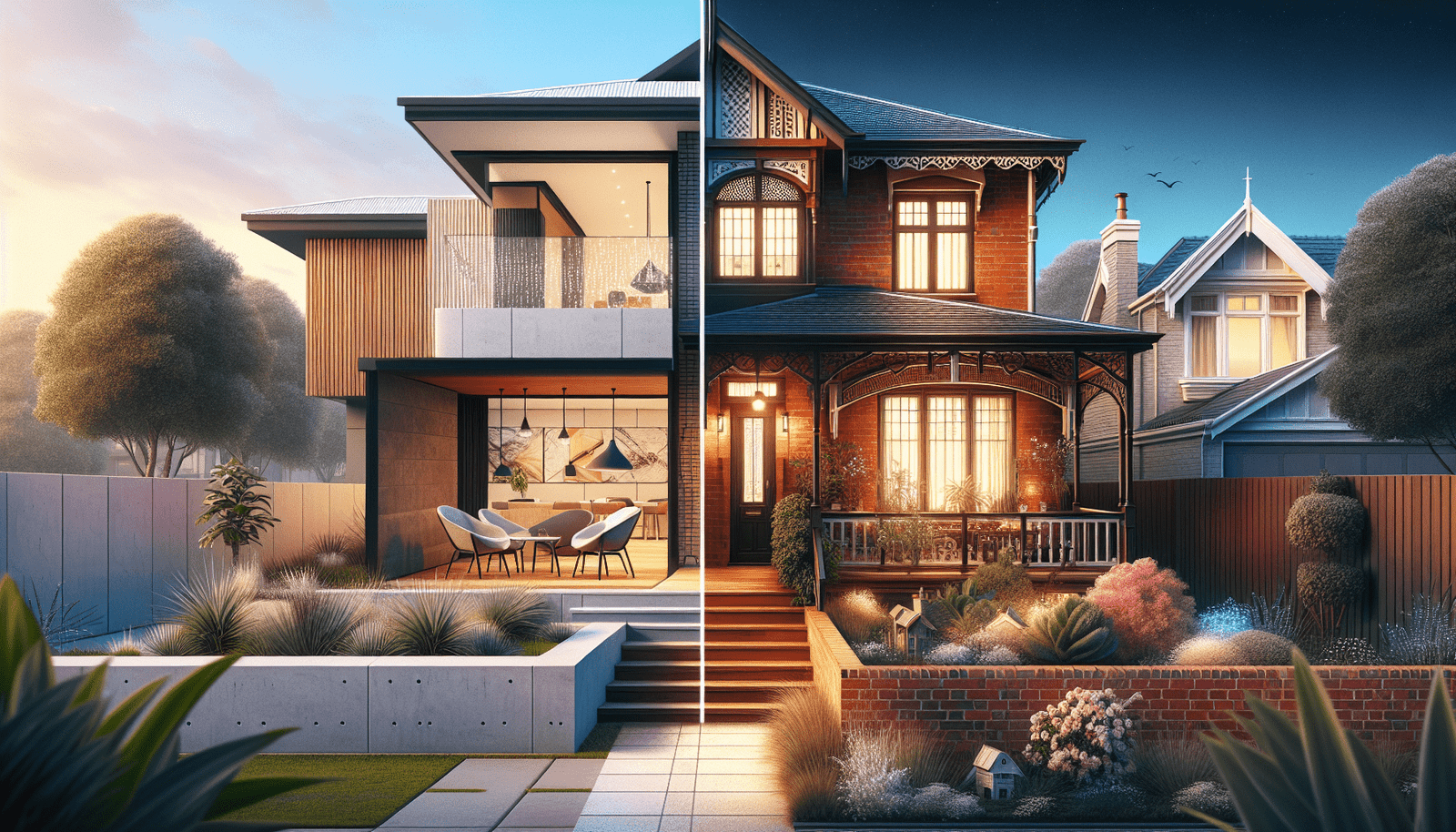

Resale vs New Build

Resale properties are existing homes that have typically been lived in before or owned by previous homeowners. On the other hand, new builds are properties that have just been constructed or are in the process of being built.

Resale properties often have history and character, while new builds offer the appeal of modern amenities and customization options. When deciding between the two, consider factors like immediate availability, maintenance costs, and personalization opportunities to determine which suits your preferences best.

Hidden Costs of Buying a Property

Purchasing a property involves more than just the price tag on the house. There are several hidden costs that you should be aware of to avoid any financial surprises down the road.

Closing Costs

Closing costs refer to the fees associated with finalizing your real estate transaction. These can include legal fees, transfer taxes, title insurance, and other miscellaneous expenses. It’s essential to budget for these costs on top of your down payment.

Home Inspection

A home inspection is a crucial step in the buying process to ensure the property is in good condition and free from major issues like structural damage or pests. While this is an upfront cost, it can save you from unexpected expenses in the future.

Property Taxes, Homeowners Insurance, and Maintenance

Owning a property comes with ongoing expenses such as property taxes, homeowners insurance, and maintenance and repairs. These costs can vary depending on the location and condition of the property, so it’s essential to factor them into your budget.

Utilities and HOA Fees

Don’t forget to account for monthly utility bills and any homeowners association (HOA) fees if you’re purchasing a property within a managed community. These recurring costs can impact your overall affordability, so be sure to include them in your financial planning.

Future Investment Value Considerations

While buying your first property is an exciting milestone, it’s essential to consider the long-term investment value of your purchase. Factors like resale potential, flexibility, and energy efficiency can influence the future value of your home.

Resale Potential

Whether you opt for a resale property or a new build, it’s wise to consider the resale potential of the property. Factors like location, market trends, and property condition can affect how much your home appreciates in value over time.

Flexibility and Customization

New builds offer the advantage of customization, allowing you to personalize the design and layout of your home. On the other hand, resale properties might offer more flexibility in terms of location and established neighborhoods. Think about your long-term plans and lifestyle preferences when making this decision.

Energy Efficiency

In today’s environmentally conscious world, energy efficiency is a factor that many buyers consider when purchasing a property. New builds often come with modern energy-efficient features that can help you save on utility bills and reduce your carbon footprint. However, older resale properties can be retrofitted with energy-saving upgrades to improve efficiency.

Emotional Aspects of Home Buying

Buying a property is not just a financial transaction—it’s also an emotional journey that comes with its ups and downs. Understanding the emotional aspects of home buying can help you navigate the process more confidently.

Decision Fatigue

With so many decisions to make during the home buying process, it’s common to experience decision fatigue. From choosing between properties to negotiating offers, the sheer number of choices can be overwhelming. Take breaks when needed and prioritize your must-haves to streamline the decision-making process.

Emotional Attachment

It’s easy to fall in love with a property at first sight, but it’s important to remain objective and consider factors beyond aesthetics. Emotional attachment can cloud your judgment and lead to impulsive decisions. Take your time to assess the practical aspects of the property before making an offer.

Buyer’s Remorse

Buyer’s remorse is a common feeling that many homeowners experience after making a significant purchase. If you find yourself doubting your decision after buying a property, remind yourself of the reasons why you chose it in the first place. Remember that it’s normal to have some apprehension when making a big financial commitment.

Navigating Your First Property Purchase

As a first-time property buyer, the journey to homeownership can be filled with a mix of excitement and apprehension. Balancing practical considerations, financial planning, and emotional readiness is key to making a sound investment that aligns with your goals.

Whether you ultimately decide on a resale property or a new build, remember that this is a significant milestone in your life. Take your time to explore your options, seek advice from real estate professionals, and trust your instincts when making decisions. Homeownership is a rewarding experience that offers stability, pride of ownership, and the opportunity to create a place where memories are made. Enjoy the journey and embrace the transition to becoming a homeowner.

Congratulations on embarking on this exciting chapter in your life as a first-time property buyer!