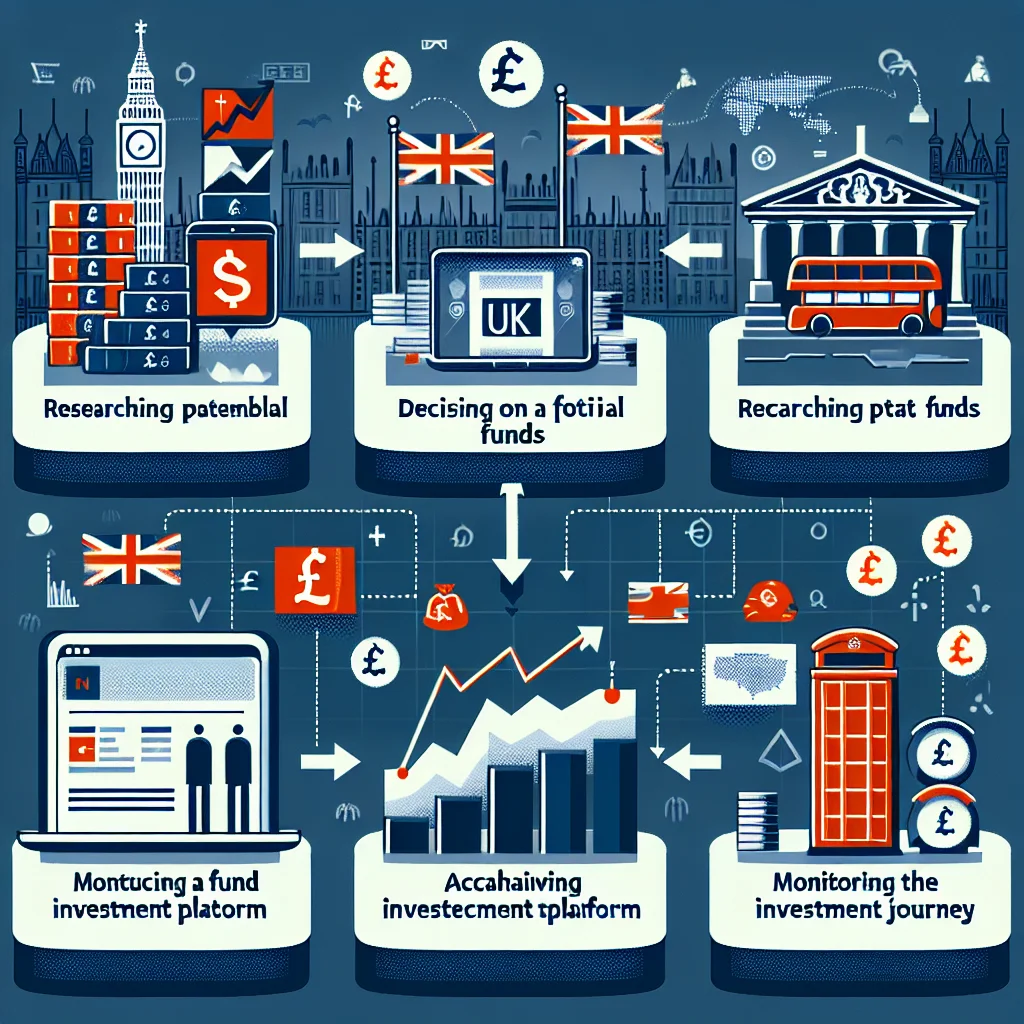

Understanding Funds

Funds pool money from multiple investors to invest in a diversified portfolio of assets such as stocks, bonds, and real estate. This allows individual investors to benefit from professional money management and diversification.

Types of Funds

There are various types of funds available in the UK, including mutual funds, exchange-traded funds (ETFs), and investment trusts. Each of these fund types have their own characteristics and advantages.

Choosing a Fund

When selecting a fund to invest in, consider factors such as your investment goals, risk tolerance, and time horizon. Additionally, look at the fund’s past performance, fees, and the fund manager’s track record.

Opening an Investment Account

To invest in funds in the UK, you will need to open an investment account with a platform or broker. Make sure to compare fees, features, and customer reviews before selecting a provider.

Investing in Funds

Once you have chosen a fund and opened an investment account, you can start investing by specifying the amount you want to invest and how you want your dividends and capital gains to be handled.

Monitoring Your Investments

It is essential to regularly monitor your fund investments to ensure they align with your financial goals and risk tolerance. Consider rebalancing your portfolio if necessary and stay informed about market trends.

Seeking Professional Advice

If you are unsure about how to invest in funds or need guidance on building a diversified portfolio, consider seeking advice from a financial advisor or investment professional.